Explain Different Types of Fringe Benefits in Detail

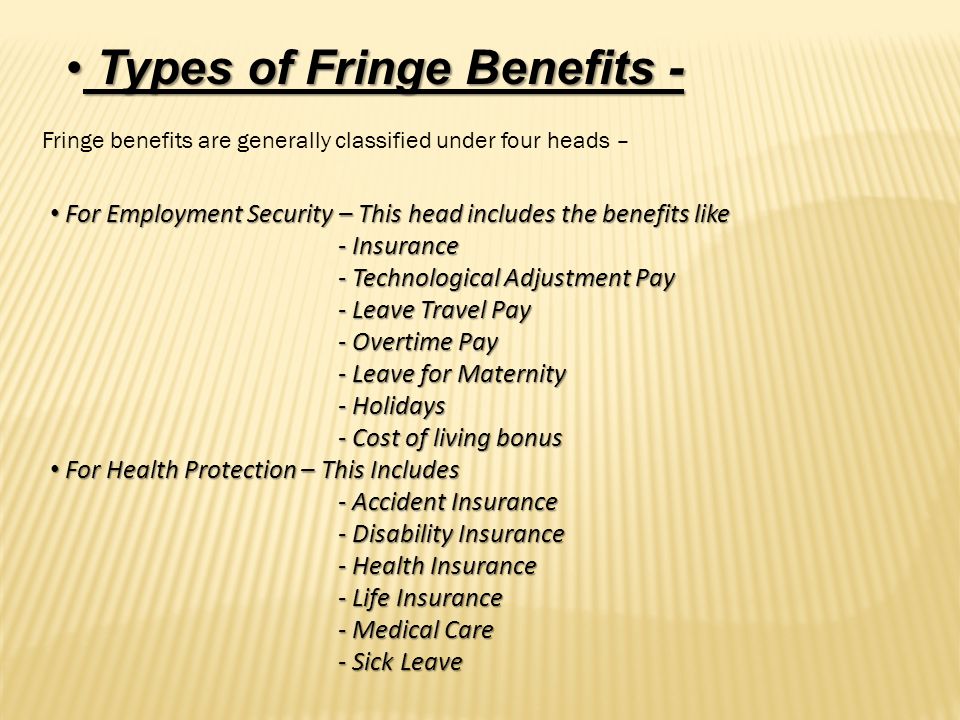

Fringe benefits are a form of compensation provided to employees outside of their standard salary or state wage. The fringe benefits are classified under four heads as given here under.

Fringe Benefits What Is Fringe Benefit What Is Fringe Benefit A Fringe Benefit Is Generally Defined As A Benefit Not Being Salary Wage Or Other Ppt Download

Safety and health 5.

. Explain different types of GST in detail. Different types of fringe benefits. And calculate remit and report federal unemployment taxes on the fringe benefits too.

They may include tuition assistance flexible medical or child-care spending. Fringe benefits tax - exempt motor vehicles. Examples of Legally Required Fringe Benefits Some.

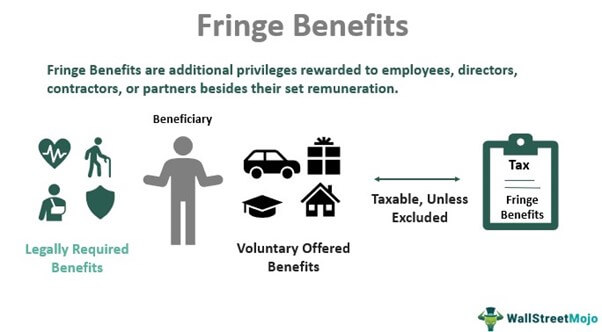

An employer is the provider of a fringe benefit even if a third party provides the actual benefit. Fringe benefits in the UK broadly fall into two categories. For instance businesses in the UK are required by.

Organizations provide a variety of fringe benefits. Generally all fringe benefits fall into three categories legally required benefits taxable benefits and non-taxable benefits. Non-taxable fringe benefits include travel allowance computer or laptop provided by the company for official use refreshment provided by employer during office hours.

Fringe benefits tax FBT Types of fringe benefits. In dual GST regime all the intra-State transactions of goods. An extensive list of fringe benefits is tax exempt and most perks are also free of Social Security Medicare and Federal Unemployment taxes.

Fringe benefits are a variety of non-cash payments are used to attract and retain talented employees. Some taxable fringe benefits include cash bonus pay paid personal time off and. Working out the taxable value of a car fringe benefit.

Explain CGST and SGST in detail. Benefits under this head include unemployment insurance technological adjustment pay. TYPES OF FRINGE BENEFITS.

Some are mandatory while others are discretional. As a quick refresher IRS Publication 15-B the Employers Tax Guide to Fringe Benefits defines a fringe benefit as a form of pay for the performance of services. Fringe benefits tax FBT is a tax on most but not all non-cash employee benefits an employer might provide to an employee.

Some of the most common fringe benefits like health and life insurance are not taxable but others are taxed at fair market value. Depending on the company these benefits may include health insurance required to be offered by larger companies dental insurance vision care life insurance legal insurance. The most common types of employee benefits offered today are.

Old age benefit 6. Appealing to both employees and. Insurance benefits usually include those for health life and disability.

India has implemented dual GST. Benefits under this head include. The fringe benefits are classified under five heads as given here.

Some of the most common tax-free types of fringe benefit provided to employees by private and public businesses include. There are a variety of types of employee fringe benefits such. Some of the most popular types of fringe benefits are discussed below.

Adoption assistance is exempt from income. Fringe benefits are taxable unless they are specifically excluded from an. Many employers offer some form of healthcare coverage as a fringe benefit.

Insurance coverage is perhaps. These non-cash employee benefits are called fringe benefits.

Fringe Benefits What Is Fringe Benefit What Is Fringe Benefit A Fringe Benefit Is Generally Defined As A Benefit Not Being Salary Wage Or Other Ppt Download

Comments

Post a Comment